What is the 4 percent rule?Are you a millennial looking to FIRE? Or perhaps a baby boomer looking to quit the rat race? How much money will you need in your nest egg to make the dream a reality? The 4 percent rule just might be your answer. The 4 percent rule is a guideline used to determine the amount of money a person should have accumulated in their nest egg to live on indefinitely. It was developed by three finance professors at Trinity University in the late 1990s. The goal of the 4 percent rule is to provide a safe income stream without ever running out of money, even during the worst economic crises. Sound too good to be true? In this article, I’ll dive into the math behind the 4 percent rule, discuss some potential problems, and illustrate some examples using actual market returns. How much money will you need to retire under the 4 percent rule? The multiple of 25 How much money will you need in your nest egg? The easy answer is to multiply your annual expenses by 25. Under the 4 percent rule, this should be enough to live on indefinitely. But, life is never easy, so let’s dig in a little deeper. First, figure out your annual expenses. Add up everything that you spend money on, and I mean everything. Housing, food, phone bill, vacations...you get the idea. Once you figure out your annual expenses, multiply the number by 25. The result will be your target nest egg needed to retire. For example:

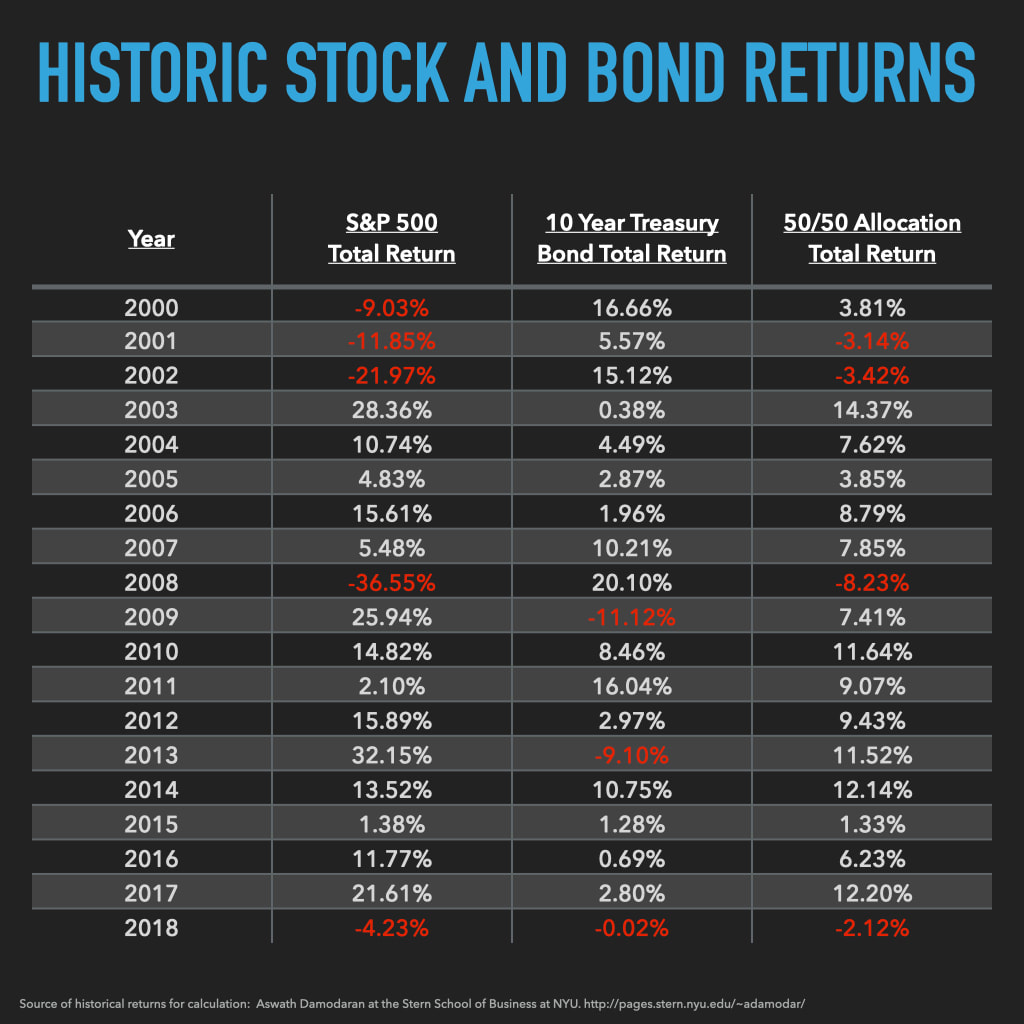

These are target goals for your nest egg. However, I will discuss some drawbacks to this method further down. You may have other sources of income during retirement, such as Social Security, a pension, 401k, or part time job. These additional sources of income can help reduce the amount that you ultimately need in your nest egg. Expense tracking appsHaving trouble calculating your annual expenses? Apps like mint.com can track your annual expenses automatically if you are willing to sync your credit card or banking account information. I personally like to charge all my expenses on my credit card, then pay off the balance in full each month. Most credit card companies have some form of expense tracking software that will break down your expenses and summarize them by category, making it very easy to track your annual spending. Let’s assume you’ve reached your target nest egg...What asset allocation should you use during retirement with the 4 percent rule?Asset allocation is a personal choice based on risk tolerance. Generally speaking, most people prefer a conservative allocation during retirement to prevent against wild price fluctuations in the market. Your risk tolerance is up to you. Some may prefer the safety of FDIC insured savings accounts and CDs, but don’t expect high returns. In fact, the 4 percent rule probably even work if you use this method, unless your FDIC insured investments happen to earn over 4%, which hasn’t happened in a long time. Others may prefer to take on more risk and allocate their investments into stocks and bonds. Since stocks and bonds tend to move in opposite directions, including both in your portfolio can protect your nest egg during bear markets. For simplicity, let’s take a look a pretty sensible allocation of 50% stocks and 50% bonds and see what kind of returns you might expect based on past performance and see if the 4 percent rule holds up. Below is a table showing a hypothetical allocation of 50% stocks and 50% bonds derived from historical total returns from the S&P 500 Index and the 10 year Treasury bond from 2000 to 2018. Total returns include both price appreciation and dividends/interest. Out of the 19 years shown, there were 7 years in which the market didn’t earn at least 4 percent. This means that your nest egg would have taken a hit in 7 out of those 19 years. This brings us to the next question. Will I run out of money if I follow the 4 percent rule?The short answer is probably not. As long as markets continue to perform at historical benchmark, you should be fine. But historical performance is merely a guideline, not a guarantee. Anything could happen out of your control.

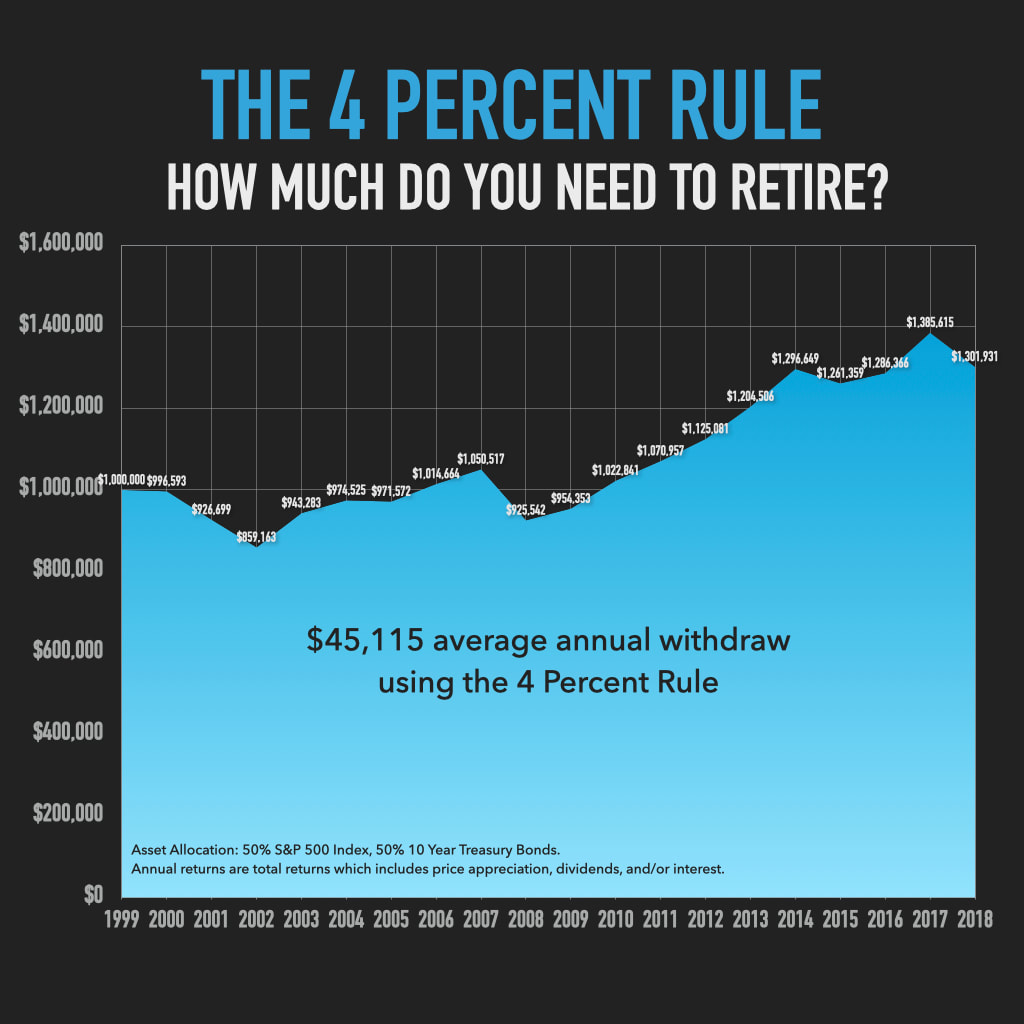

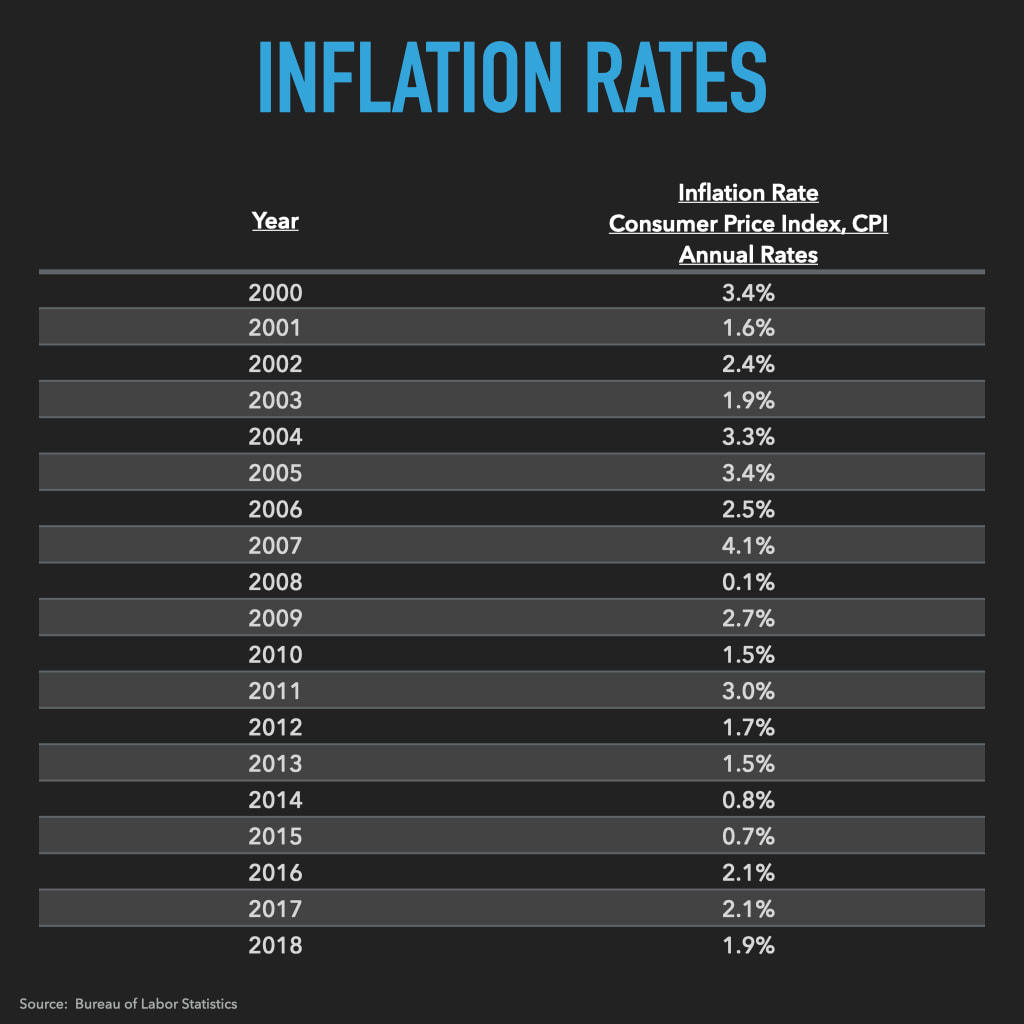

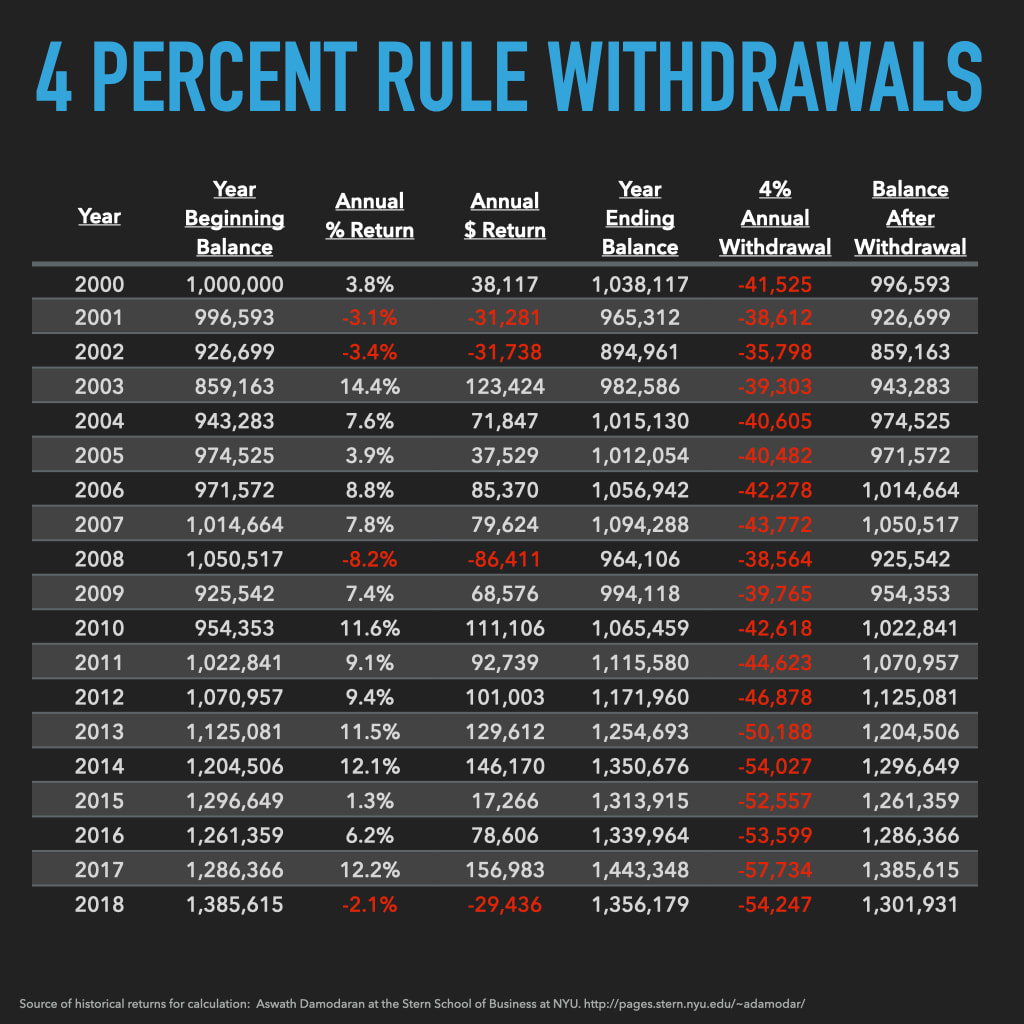

Some of these problems can be mitigated, but problems with the economy are largely out of your control. So, stressing over future unknowns that are out of your control is really a wasted worry. Instead, focus on what you can control, like properly allocating your nest egg. Also, the question of whether you will run out of money depends on what you invest in. If you have your money sitting in an FDIC insured savings account earning 2% or less each year and withdraw 4%, you run a high risk of running out of money. Since you would be withdrawing more than you earn, your nest egg would start to diminish. What are some problems with the 4 percent rule?Two potential problems with the 4 percent rule are: 1. The 4 percent rule doesn’t account for inflation. Or does it? 2. Withdrawal amounts may fluctuate with market performance. Potential problem #1: Inflation and the 4 percent rule This first potential problem with the 4 percent rule is inflation. In short, inflation means rising prices. Unfortunately for us, the prices of basic needs like food, healthcare, education and housing seems to be going through the roof. While prices of luxury goods like computers, 4K TVs, and other discretionary purchases are falling. If the cost of living rises and prices skyrocket, you may be tempted or even forced to withdraw more than 4 percent. Doing this poses a real risk of depleting your nest egg. However, the good news is that any inflation should show up in stock prices. See, just like food, healthcare, and other living expenses, stock prices go up in value too. If inflation is going up, so should stock prices. Think of it this way, if your portfolio earns 7% per year and inflation runs 2%, your “real” net gain for the year is 5%. So, assuming you withdraw 4%, your “real” net gain would be 1%. But, that may not be enough cushion for most. Below is a table showing inflation rates since 2000. For each year, you would have to earn at least the inflation rate plus your 4% annual withdrawal just to stay even with rising prices. For example, in 2007 when inflation was 4.1%, you would have to earn at least 8.1% to stay even (4% withdrawal plus 4.1% inflation). Potential problem #2: Withdrawals and the 4 percent rule Another problem with the 4 percent rule is that withdrawals during down years may yield you less income. Let’s say you started with $1,000,000 in the first year. For simplicity, let’s say you earned 4% which equates to $40,000. Under the 4 percent rule, you would withdraw $40,000 at year end. The net result is that you still have your $1,000,000 at year end. Now, assume the market declines by 4% the following year. Your year end investment is now worth $960,00. A 4% withdraw from $960,000 equals $38,400, which is short of your $40,000 anticipated withdraw form the previous year. For those without other sources of income outside of your nest egg, this can cause a real strain, especially if inflation causes a rise in living expenses. However, the opposite can happen when the market is up. If the market were to increase the following year by 8%. Then your $960,000 grows to $1,036,800. A 4% withdraw on this amount would be $41,472. These fluctuations tend to average out over time. Historically since 1928, the weighted geometric average of a portfolio invested 50% in the S&P 500 and 50% in 10 year Treasury bonds has yielded around 7%. Assuming a 4% withdrawal rate, this would theoretically leave you 3% wiggle room for inflation. What happens if I retire right before a financial downturn? Will the 4 percent rule hold true? As mentioned above, stocks can fluctuate year by year. What would happen if you decided to retire right before a market crash? Does the 4 percent rule pose a threat? Let’s look back to 2000 when the dot com bubble burst and 9/11 caused worldwide financial turmoil followed by a 6 year recovery, then another financial crash in 2008 fueled by the subprime mortgage and banking meltdown. Where would a hypothetical portfolio of 50% stocks and 50% bonds be today using a 4 percent annual withdrawal rate? Below is a table showing what would happen if you invested $1,000,000 right before the crash of 2000 and withdrew 4 percent each year throughout the market ups and downs. As you can see from 2000 to 2006, it took 7 years for your nest egg to recoup the losses and recross the original $1,000,000 threshold. Also, take note of the fluctuations in withdrawal amounts year by year. By the end of 2018 your nest egg would have grown to $1,301,931. SummaryHere’s a quick summary of the 4 percent rule:

0 Comments

Leave a Reply. |

AuthorDaniel is a CFP® with over 15 years of accounting, tax, and financial planning experience. Archives

October 2022

Categories |

RSS Feed

RSS Feed